How to See Dont Show Me Again Prompt Insurancey

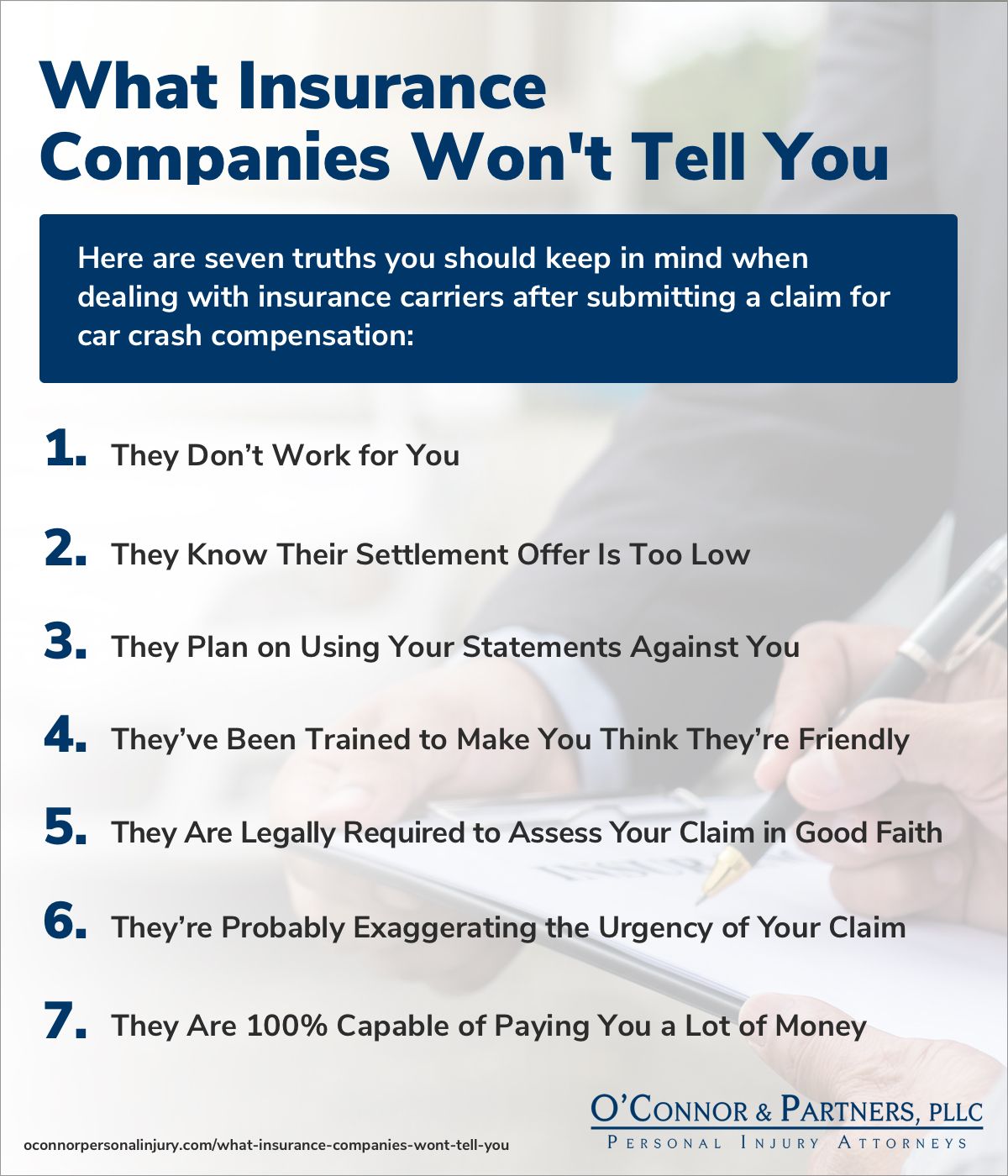

What Insurance Companies Won't Tell Yous After a Auto Accident

We all know what their commercials say: they're similar a skillful neighbour, they're at that place when yous need them, they're on your side.

Only the truth is that insurance companies are not on your side.

As a matter of fact, in that location's a lot they won't tell you — things you need to know.

Below, nosotros present 7 truths you should proceed in mind when dealing with insurance carriers after submitting a claim for car crash compensation.

ane. They Don't Work for You

Information technology's easy to assume that the insurance companies are working hard to "get to the bottom" of an car accident or to "do the right thing." Yous might even believe that your own insurance company has an obligation to represent your best interests.

Unfortunately, they don't — and they won't.

Insurance companies are for-turn a profit corporations. Their biggest concern, above all else, is their bottom line. They would rather pad their ain pockets than yours. And at the end of the day, they care more than about their shareholders than yous.

That doesn't mean insurance companies don't take whatsoever obligations at all. They do. Specifically, they must abide by:

- The terms of the relevant insurance policy

- Applicative land and federal law

- Whatsoever promises they've fabricated yous

- Their duty of good faith (which nosotros'll discuss more than beneath)

Just don't make the mistake of confusing those obligations with a duty to work toward your all-time do good. That's the kind of duty you lot can expect from an attorney — but insurance companies never act equally your agent. (Think: an insurance agent is an amanuensis of the insurer, not the insured!)

This rule cuts both ways also. Neither your insurance company nor the other drivers' insurance companies are working for y'all.

And at the end of the twenty-four hours, if the claims adjustors assigned to your case tin can find whatsoever way to pay you less money — or no money — they'll take it in a heartbeat.

2. They Know Their Settlement Offer Is Too Depression

If you've received an early settlement offer from an insurance carrier, it'due south a safe bet that the offering represents less than y'all're really owed. Probably a lot less. And the insurance company already knows that.

"Lowball offers" are standard practise for insurance companies. This is how they make their money. Remember: insurers are some of the nearly "filthy rich" corporations in the world.

In fact, insurers often like to set their initial offers so low that, fifty-fifty if they accept to bump up the offering over and over once more during the negotiation procedure, they'll even so ultimately save money. They're already thinking ahead.

Some insurance companies even adopt a "deny first" strategy, which means they might deny your claim even if they call back it's valid and worth a lot of coin. And while insurers can get in trouble for doing that (and may even owe yous punitive damages as a result), it happens all the fourth dimension.

In and so many cases, insurance companies don't come to the table with a fair and reasonable settlement offer until an experienced and aggressive New York auto accident lawyer gets involved.

3. They Program on Using Your Statements Against You lot

You lot've probably seen TV shows where someone gets arrested and the police recite a familiar line: "Anything you say or practise can be used against you lot…"

Insurance companies should tell y'all the same thing when you answer your phone. They don't, mind you. Simply they should.

That's because insurance adjusters have been trained to expect for statements or actions that they tin can twist into admissions of liability or "acts inconsistent with" the claims y'all've made. They might fifty-fifty try to lead you into making contradictory statements or saying things confronting your best interests.

Talking to insurers tin can be catchy. While y'all do have an obligation to talk to your ain insurance company after an auto accident and to reasonably cooperate with their investigation of the claim, you should be conscientious about talking to the other drivers' insurers. Considering when y'all exercise, y'all're talking to someone who is actively working confronting you.

It's best to hire a Kingston machine accident lawyer and let them do the talking for you.

4. They've Been Trained to Make You Call up They're Friendly

When the insurance companies call, they might audio genuinely concerned, truly friendly, and downright eager to help.

And hey, they might be very nice people. But they take a job to exercise, and that job is to keep yous from getting the money you deserve.

Many insurance companies railroad train their representatives and adjusters on how to sound friendly and outgoing. They exercise this because they want yous to open upwards to them, to tell them more than than you have to, and to permit your guard downwards (because when you exercise, you lot might end up making statements that hurt your instance).

A friendly person is always easier to talk to than a rude person. But don't let a warm personality lure you into undercutting your ain claim.

5. They Are Legally Required to Assess Your Claim in Skilful Organized religion

"Good faith" is a complex legal doctrine, but it's premised on a pretty simple notion: people should treat each other honestly, reasonably, and adequately. And that's exactly how insurance companies are required (by law) to assess your claim.

When insurers investigate or negotiate a claim in bad religion, they tin can arrive a lot of trouble. In fact, they might even have to pay you (the victim) a lot more coin in the form of punitive damages.

Unfortunately, New York courts have historically been a niggling more than insurer-friendly than many other states when it comes to the question of bad faith damages. But that doesn't mean the insurance companies here are allowed to proceed in bad faith or that you can't recover if they do.

At O'Connor & Partners, we work aggressively to brand sure insurance companies meet their good faith obligations, and if they breach that duty, our Kingston auto accident attorneys are prepared to have action.

6. They're Probably Exaggerating the Urgency of Your Claim

Has the insurance company made yous experience like you need to human action fast if y'all desire the settlement coin they're offer you? Take they told you it's a express-time offer? Do they seem to be in a hurry? Do y'all feel rushed?

All of this is past design.

The whole point of an early on settlement offer is this: the insurance company hopes they can entice you with a relatively minor corporeality of "quick cash" and, in exchange, get yous to sign away your rights to additional bounty. In most cases, if you do take that settlement, you'll permanently lose your ability to come up back and claim more than later.

No wonder they're in such a hurry!

But you don't have to be.

Information technology is truthful that you lot tin't wait forever to make a claim for damages after a New York auto blow. A strict legal time limit, known as a statute of limitations, does utilize.

But the statute of limitations is a number of years (iii years for most car crashes in New York, or two years if there'due south a wrongful death claim) — not weeks, equally the insurance company would like you to believe.

You should absolutely take prompt activeness on your claim. There is zero to gain by delaying, and the claims procedure takes time, so y'all should avoid waiting until the end of the statute of limitations. Only you should as well make a fully informed decision. That means contacting an experienced Kingston auto accident lawyer to find out what your options are. Practise that sooner than subsequently.

At O'Connor & Partners, nosotros offer completely free consultations for accident victims — 100% confidential and with no obligations whatsoever. Nosotros can help you lot understand how much your case might really be worth and whether the insurance visitor's settlement offer is fifty-fifty close to being fair.

7. They Are 100% Capable of Paying You a Lot of Coin

If you've been injured in a motorcar crash, or if y'all've suffered losses because of it, you deserve to exist made whole once again. While the New York legal system cannot disengage injuries or plough dorsum time, it tin laurels you acceptable compensation to assist you pay your bills and get your life back on track.

And make no mistake about it: the insurance companies accept enough of money to make that happen.

The attorneys at O'Connor & Partners have recovered millions of dollars from insurance companies in settlements and verdicts in the by. That'due south what makes it so ridiculous when insurers balk at paying much smaller amounts on claims that are clearly legitimate and worthy.

Not every claim is worth a 1000000 dollars. For that matter, it'due south incommunicable to predict an verbal dollar amount or outcome for any given example. Simply as a full general principle, y'all should sympathize that insurance companies are fully capable of coming together their obligations — and you should wait them to do so. An experienced auto accident attorney in Kingston can aid.

Schedule a Free Consultation with O'Connor & Partners

Have you been injured in a vehicle accident acquired by someone else's negligence? Has an insurance visitor made you an offer and you're not sure how to respond? Requite usa a call.

At O'Connor & Partners, we are happy to offering no-cost, no-risk consultations. Fifty-fifty better, if you lot do cease up hiring united states after the consultation, we will non accuse a fee unless we get you money first.

Nosotros serve clients in Kingston, Newburgh, Poughkeepsie, Ellenville, the Hudson Valley, New York Urban center, and across. If you tin't come to us, nosotros'll come to you! Merely contact us online or call (845) 303-8777 to talk with an experienced Kingston motorcar accident attorney today.

Source: https://www.oconnorpersonalinjury.com/what-insurance-companies-wont-tell-you/

0 Response to "How to See Dont Show Me Again Prompt Insurancey"

Enviar um comentário